Investment banking is a highly competitive and ever-evolving industry, driven by strategic decision-making, complex financial markets, and influential leaders. As of 2022, several business magnates have stood out for their visionary leadership, strategic decisions, and immense success in the world of investment banking. These individuals have not only shaped their companies but have also had a profound impact on global financial systems. Let’s take a closer look at some of the most influential figures in the investment banking world.

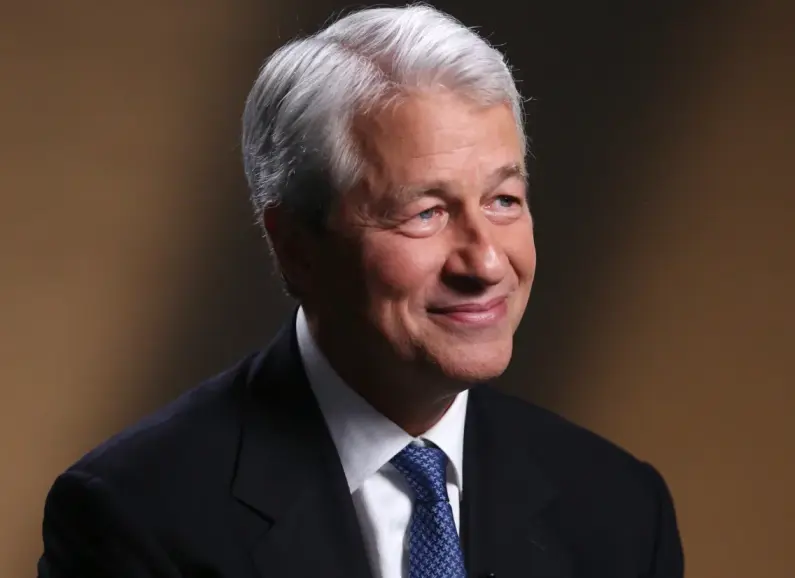

1. Jamie Dimon – CEO of JPMorgan Chase

Jamie Dimon is arguably one of the most well-known figures in the investment banking industry. As the Chairman and CEO of JPMorgan Chase, Dimon has led the firm to become one of the largest and most successful financial institutions in the world. Under his leadership, JPMorgan Chase navigated the global financial crisis of 2008 and emerged stronger, a testament to his strategic foresight and risk management acumen.

Dimon’s leadership has been marked by his focus on maintaining a robust and diversified business model, expanding JPMorgan Chase’s reach globally, and investing heavily in technology and digital banking. His bold moves, including the acquisition of Bear Stearns during the 2008 crisis, have solidified his reputation as a resilient and visionary leader. Dimon’s influence extends beyond JPMorgan Chase; he has been an outspoken advocate for reform in banking regulations and has shaped discussions on the future of finance.

2. Lloyd Blankfein – Former CEO of Goldman Sachs

Lloyd Blankfein served as the Chairman and CEO of Goldman Sachs from 2006 to 2018, guiding the firm through one of the most tumultuous periods in financial history. Blankfein played a crucial role in navigating Goldman Sachs through the 2008 financial crisis, positioning the firm as one of the few major banks to emerge relatively unscathed. His leadership during the crisis helped Goldman Sachs maintain its position as one of the leading investment banks in the world.

Blankfein’s time at Goldman Sachs was also marked by a focus on global expansion and innovation in financial products and services. Under his guidance, Goldman Sachs solidified its reputation for high-level investment banking, trading, and wealth management. Although he stepped down from the CEO position in 2018, Blankfein’s influence in the industry remains profound, and his legacy continues to shape Goldman Sachs’ strategic direction.

3. David Solomon – CEO of Goldman Sachs

David Solomon, who succeeded Lloyd Blankfein as CEO of Goldman Sachs in 2018, has quickly made his mark as one of the industry’s most innovative leaders. Solomon’s vision for Goldman Sachs has focused on transforming the firm into a more diversified financial institution. Under his leadership, Goldman Sachs has increasingly embraced technology and fintech, expanding into consumer banking with the launch of Marcus by Goldman Sachs—a digital consumer banking service offering personal loans and savings accounts.

Solomon’s leadership also emphasizes sustainable finance and the transition to a low-carbon economy. Goldman Sachs has made significant strides in incorporating environmental, social, and governance (ESG) factors into its investment strategies under Solomon’s direction. Additionally, Solomon’s efforts to modernize Goldman Sachs’ operations, including embracing digital currencies and blockchain technology, are setting the firm up for long-term growth in an evolving financial landscape.

4. Stephen Schwarzman – CEO of Blackstone Group

As the CEO of Blackstone Group, one of the world’s largest investment firms, Stephen Schwarzman has had a profound impact on the private equity and alternative investment industries. Schwarzman co-founded Blackstone in 1985, and over the years, he has transformed the firm into a global powerhouse managing billions of dollars in assets. Blackstone is particularly well-known for its private equity, real estate, and credit businesses, and under Schwarzman’s leadership, the firm has expanded its investment portfolio significantly.

Schwarzman’s keen investment strategies, combined with his leadership in expanding Blackstone’s global presence, have solidified his position as one of the most influential figures in finance. Beyond his work at Blackstone, Schwarzman is known for his philanthropic efforts, particularly in the fields of education and public policy. His ability to navigate complex markets and lead Blackstone through significant growth has earned him recognition as one of the most successful investment bankers of his generation.

5. Ray Dalio – Founder of Bridgewater Associates

Ray Dalio is the founder of Bridgewater Associates, the world’s largest hedge fund, which manages over $100 billion in assets. Dalio is widely regarded as one of the most innovative minds in investment management, with a unique approach to investing that blends macroeconomic analysis, data-driven decision-making, and a deep understanding of global financial systems.

Dalio’s success can be attributed to his philosophy of “radical transparency” and his focus on principles-based decision-making. Under his leadership, Bridgewater has generated remarkable returns for its investors, especially through its flagship Pure Alpha strategy, which focuses on diversification across a wide range of asset classes. Dalio is also known for his research on economic cycles and the concept of debt crises, which has made him a leading voice on global economic trends.

Despite stepping down from day-to-day management at Bridgewater, Dalio’s influence continues to shape the investment world, particularly in the areas of hedge fund strategy, global macro investing, and economic forecasting.

6. Mary Erdoes – CEO of J.P. Morgan Asset & Wealth Management

Mary Erdoes is the CEO of J.P. Morgan Asset & Wealth Management, a division of JPMorgan Chase. Erdoes has been instrumental in growing the firm’s asset management and wealth management businesses into one of the largest in the world. Under her leadership, J.P. Morgan has significantly expanded its global footprint in asset management and wealth management services, catering to high-net-worth individuals and institutional investors.

Erdoes is known for her strategic thinking and her ability to build strong client relationships. She has been a key driver behind JPMorgan’s push into the rapidly growing field of sustainable investing, with an emphasis on ESG strategies. As one of the few women in top positions within investment banking, Erdoes serves as a role model for aspiring leaders and has been recognized for her contributions to both finance and diversity in the workplace.

Conclusion

The investment banking industry is full of influential leaders who have shaped the financial world through innovative strategies, strategic thinking, and strong leadership. As of 2022, figures like Jamie Dimon, Lloyd Blankfein, David Solomon, Stephen Schwarzman, Ray Dalio, and Mary Erdoes have made lasting impacts on their firms and the industry as a whole. These leaders have demonstrated resilience in navigating economic challenges and have been instrumental in driving the evolution of investment banking, ensuring that their legacy will continue to influence the industry for years to come.

Leave a Reply